No More Dry Erase Markers Because of…Taxes?

The GOP continues to work to pass a tax bill that will affect millions of Americans

In the wee hours of Saturday morning on December 2nd, the Senate passed a tax plan in a 51-49 vote that will affect millions of Americans. The 479 page tax plan was given to some members of Congress only a few hours before the vote in a rush to get the piece of legislation passed.

The bill seemed to be quickly thrown together as Senator Jon Tester of Montana pointed out in a tweet the night before the vote: “One page literally has hand scribbled policy changes on it that can’t be read. This is Washington, D.C. at its worst.”

The rush to get the bill passed seemed interesting to some at Hickman, as they reflected on how their own teachers would react to a paper being turned in with adjustments made to a typed paper with a marker.

“That just wouldn’t be okay if it were like a homework assignment. A teacher wouldn’t accept it. That’s just unprofessional,” freshan Arual Kuol said.

According to Dina Mugeni, a junior at Hickman, submitting a piece of legislation that affects millions of lives with markups in pen on the side, “probably won’t get an A” if it were to be judged at some of the same standards as teens at Hickman.

A freshman at Hickman, Simmone Acock agrees with Kuol on how she believes a teacher would react: “It’s almost like a rough draft. I think a teacher would honestly be like, ‘are you finished?’”

However, many students, including Acock, are still confused about how the Republican tax plan could influence teens their age.

“I think they affect us when we get a job, I guess?” Acock said. “I mean, even when we go to the store, they add taxes to everything we buy, but that’s all I really know about them.”

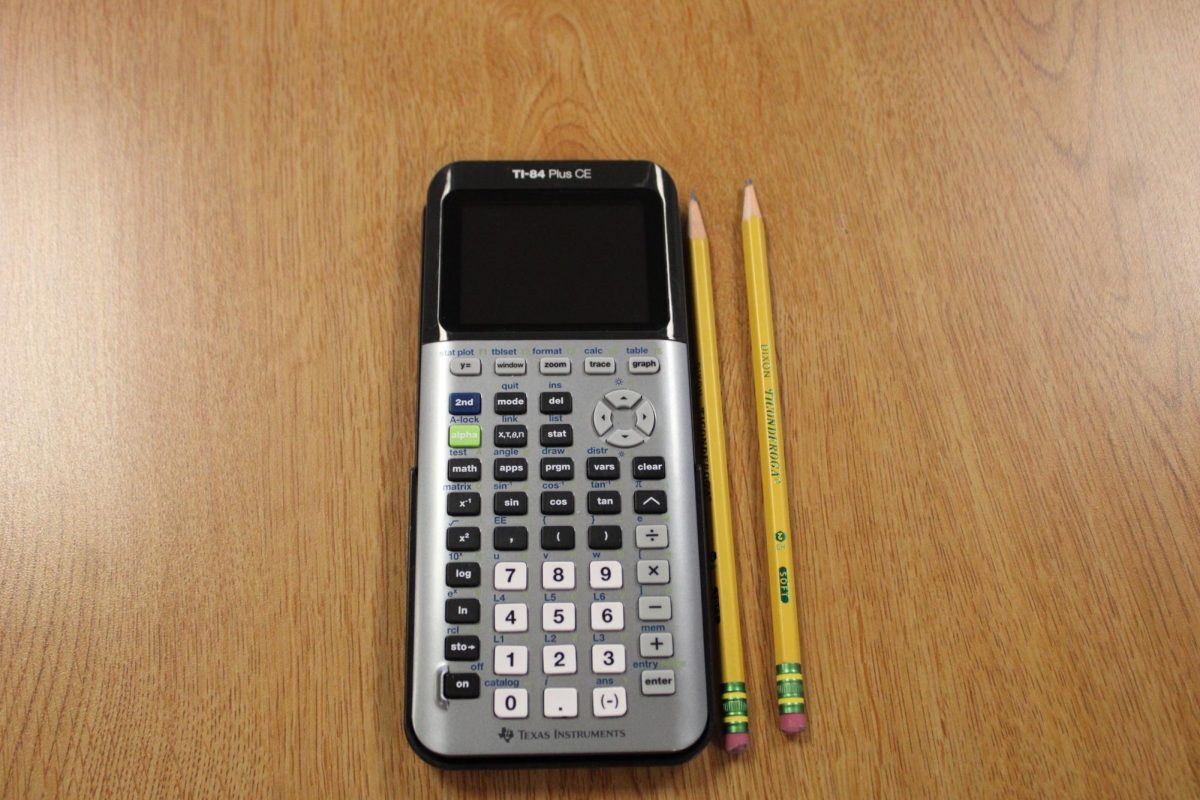

The tax plan that recently passed in the Senate might actually affect the day to day lives of teens in small ways that quickly become more prominent as they age. For example, based on Senate for American Progress estimates, the Betsy Devos family would get a nearly two billion dollar tax break while the $250 tax credit for teachers to buy school supplies, which also costs two billion dollars, would be cut. This means that teachers will have to pay for more school supplies out of pocket, or not purchase the supplies at all. Because of this, kids might not be provided things such as tissues, hand soap, hand sanitizer and cleaning wipes, all of which are musts for keeping a healthy classroom. Glue sticks, pencils, erasers and dry-erase markers are also common items that need to be replenished throughout the year and will thus have to be paid for by teachers more often if they are not granted by this tax credit.

“I already know some teachers that pay for extra supplies on their own,” sophomore, Iyanna Moss said. “And they already don’t get paid enough I think, and that’s not fair.”

This elimination of funds for teachers might lead to some students having to pick up the extra slack and buying more of their own school supplies if they can’t be provided.

As seniors go off to college and then grad school, they will face another obligation. Tuition waivers would soon count as income for graduate students, requiring them to pay thousands more in taxes each year. In addition, the Republicans in Congress voted down a requirement for big corporations to increase wages and hire more people if they were given a higher tax break. Part of the legislation would, by the year 2027, also lead to an increase in taxes on those making between forty and fifty thousand dollars a year while offering tax breaks to those making over a million dollars, according to CBS.

What does this mean for teens and those entering college soon? This tax plan could imply that it will not be any easier to get hired, even though these big corporations will have more money to spend on a workforce. Yes, the position at the local fast food chain will still be open, but do not expect fifteen bucks an hour starting out. If teens at Hickman are not millionaires by 2027, they will most likely be paying more in taxes because of this bill.

So what is next for the tax plan? The bill is headed to a conference committee. This is when Republican leaders appoint a group of people they trust to hash out the differences between the House’s and the Senate’s version of the bill. Nobody is wasting time on this though; House Speaker Paul Ryan announced over the weekend that he’d reveal those that will negotiate the tax bill before the first few weeks of December are over.